3 BLACK SHORE OPTION PRICING MODEL

The quantum of speculation is more in case of stock market derivatives and hence proper pricing of options eliminates the opportunity for any. Introduction The Black-Scholes option pricing model BSOPM has been one of the most important developments in finance in the last 50 years 3 Has provided a good understanding of what options should sell for Has made options more attractive to individual and institutional investors 4.

Black Scholes Model Definition

The Black and Scholes Option Pricing Model didnt appear overnight in fact Fisher Black started out working to create a valuation model for stock warrants.

. We do not know what the price of the stock will be. Let us examine a call option. At the same time volatility is one of the inputs for the model which have the greatest effect on the resulting option price.

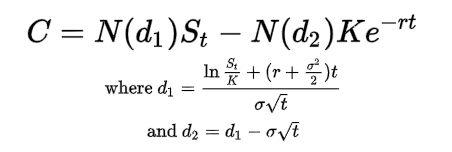

The Black-Scholes Option Pricing Model is an analytical framework used to determine the fair price of stock options. The 3 rd row shows the Black Scholes call option for the specified parameters and varying spot price. 5 Stock Price Model.

We can hedge it by buying a share of the underlying asset. Please note that though the post shows the. Black-Scholes assumes a normal probability distribution the bell-shaped curve of.

A Delta of 03 means that the options price would increase by 03 for a 1 increase in the underlyings price. The increment presently of 10 points can be changed from Cell I2 and then drag it across the range horizontally. The model is popularly known as Black 76 or simply Blacks model.

Call Option Premium Put Option Premium Call Option Delta Put Option Delta Option Gamma. This assumption is of course very problematic in the real world volatility is neither constant nor known in advance. Option position would then tend to be o set by the loss gain on the stock position.

A put option is the opposite of a call. Values for a call price c or. Under the Black-Scholes model volatility is constant doesnt change in time and known in advance.

Remember that the actual monetary value of vested stock options is the difference between the market price and your exercise price. On the Q-quant side there is a whole host of advanced techniques which attempt to more realistically model the underlying dynamics and are able to much better approximate market option prices and when translated into the Black-Scholes language produce a vol smile similar to ones empirically observed on the market. It is also used for pricing interest rate caps and floors.

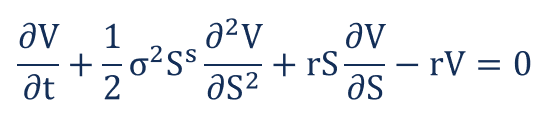

Black-Scholes is a pricing model used to determine the fair price or theoretical value for a call or a put option based on six variables such as volatility type of option underlying stock price time strike price and risk-free rate. This work involved calculating a derivative to measure how the discount rate of a warrant varies with time and stock price. From the partial differential equation in the model known as the BlackScholes equation one can deduce the BlackScholes formula which gives a theoretical estimate of the price of European-style.

The Black-Scholes Option Pricing Model The model Development and. For example if we write a naked call see Example 52 we are exposed to unlimited risk if the stock price rises steeply. The BlackScholes model is a mathematical model simulating the dynamics of a financial market containing derivative financial instruments such as options futures forwards and swaps.

The Black-Scholes formula helps investors and lenders to determine the best possible option for pricing. Delta for call options is Nd 1 and Nd 1. The model is widely used for modeling European options on physical commodities forwards or futures.

It enables one to sell the stock at a specific price and time. To learn more about the the Black-Scholes. Excel-based Investment Research Solution for Serious.

The result of this calculation held a striking resemblance to a well-known heat transfer equation. Black-Scholes Equations 1 The Black-Scholes Model Up to now we only consider hedgings that are done upfront. This is done at the initial time when the call is sold.

Blacks option pricing formula reflects this solution modeling a forward price as an underlier in place of a spot price. 3 Check your securities MF bonds in the consolidated account statement issued by NSDLCDSL every month. C SP e-dt Nd 1 - ST e-rt Nd 2 P ST e-rt N-d 2 - SP e-dt N-d 1 d 1 lnSPST r - d σ 2 2 t σ t.

Black-Scholes期权定价模型Black-Scholes Option Pricing Model布莱克-肖尔斯期权定价模型1997年10月10日第二十九届诺贝尔经济学奖授予了两位美国学者哈佛商学院教授罗伯特默顿RoBert Merton和斯坦福大学教授迈伦斯克尔斯Myron Scholes他们创立和发展的布莱克斯克尔斯期权定价模型Black Scholes. Black Scholes Option Pricing Formula. The online calculator we used before gives us a value of 1222 for the.

The data and results will not be saved and do not feed the tools on this website. The Model takes into account the stocks current price the strike price the time remaining until the option expires market volatility and the interest rate. The original Black-Scholes model works on the assumption of a European option.

The key property of the model is that it shows that an option has a unique price regardless of the risk of the underlying security and its expected return. The Black Scholes Calculator uses the following formulas. The Black Scholes model models European options even though American options that can always be exercised are far more common.

To calculate a basic Black-Scholes value for your stock options fill in the fields below. Volatility Interest Dividend. The BlackScholes ˌ b l æ k ˈ ʃ oʊ l z or BlackScholesMerton model is a mathematical model for the dynamics of a financial market containing derivative investment instruments.

Using the same input values in the previous equation gives us the theoretical price of the put option at the same strike. If the stock price goes up by 1 producing a gain of 60 on the shares purchased the option price would tend to go up by 06 1 06 producing a loss of 06 100 60 on the call option writtenHull 2000. The 4 th row shows the Black Scholes put option for the specified parameters and varying spot price.

/BlackScholesMerton-56a6d22e3df78cf772906866.png)

Black Scholes Model Definition

Pin By Trading Tuitions On Options Trading In 2021 Premium Calculator Implied Volatility Graphing

10 Mathematic Equations That Changed The World Mathematical Equations Life Hacks For School Equations

Black Scholes Model In Python For Predicting Options Premiums The Startup

Option Pricing Model Financial Management Financial Strategies Accounting Notes

Black Scholes Option Pricing Excel Formula Excel Formula Option Pricing Excel

Black Scholes Merton Model Overview Equation Assumptions

What Is The Black Scholes Model Option Pricing Matrix Multiplication Option Trading

/BlackScholesMerton-56a6d22e3df78cf772906866.png)

Belum ada Komentar untuk "3 BLACK SHORE OPTION PRICING MODEL"

Posting Komentar